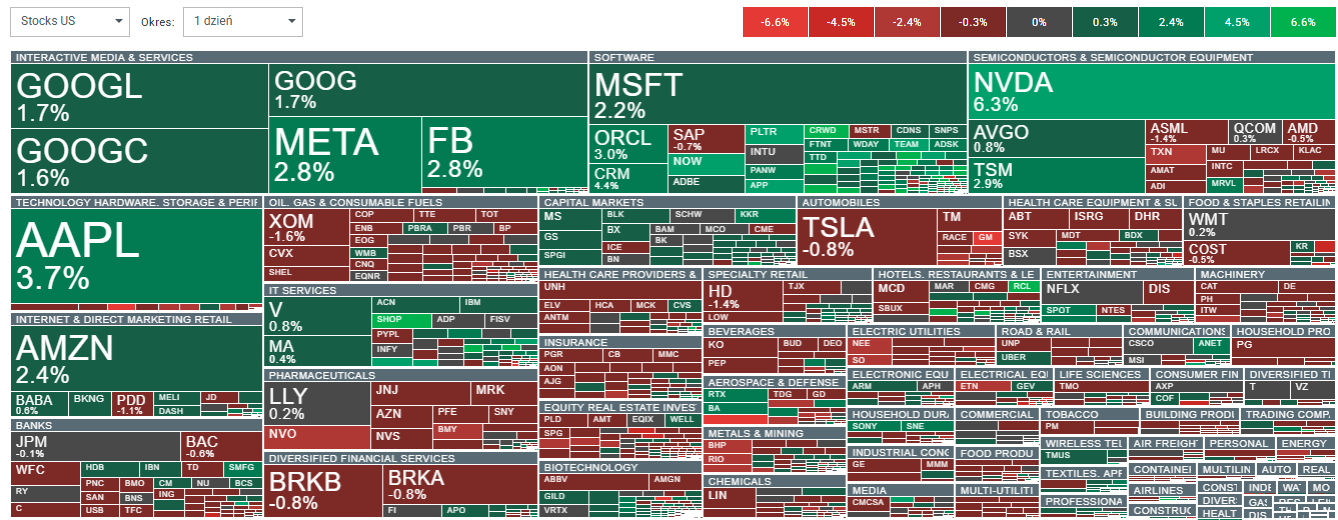

Futures on Nasdaq 100 (US100) are up nearly 1.2% as BigTech stocks recover losses following yesterday's sell-off. Nvidia is surging over 6%, while Meta, Taiwan Semiconductor, and Apple are gaining between 2.8% and 3.8%. As shown on the dashboard below, overall sentiment across the US stock market outside the technology sector is mixed after weaker-than-expected macroeconomic data released today.

- Durable goods orders in the US fell by -2.2% month-over-month in December 2024, with November’s data revised down from -1.2% to -2%. Similarly, the Conference Board Consumer Confidence Index for January disappointed, as investors had expected a reading around 106 but received a figure of 104.1, with a notable weakening in the assessment of current conditions. Despite this, the US dollar has strengthened significantly ahead of tomorrow’s Fed decision, scheduled for 7 PM GMT. Bitcoin is gaining slightly, once again reaching the $102,000 level.

- The CEO of Scale AI claims that DeepSeek held nearly 50,000 Nvidia H100 AI chips, but the company did not report this. According to a Wedbush note: "Bears missed the historic rally in tech stocks over the last 2 years and will miss the next 2 years, endlessly waiting for a black swan to end the AI Revolution trade. From Fed days to rumors of Nvidia Blackwell delays to Tokyo Black Monday… today is no different with DeepSeek… a buying opportunity." Today, OpenAI launched ChatGPT Gov in the US, tailored for US government agencies. On the other hand, it remains uncertain whether DeepSeek will negatively impact infrastructure providers’ backlogs and future revenues.

Source: xStation5

Source: xStation5

US100 is one step closer to testing the EMA200 on the hourly interval, recovering nearly 50% of yesterday's declines.

Source: xStation5

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

📈Wall Street rebounds, VIX slips 5% 🗽What does US earnings season show us?

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.