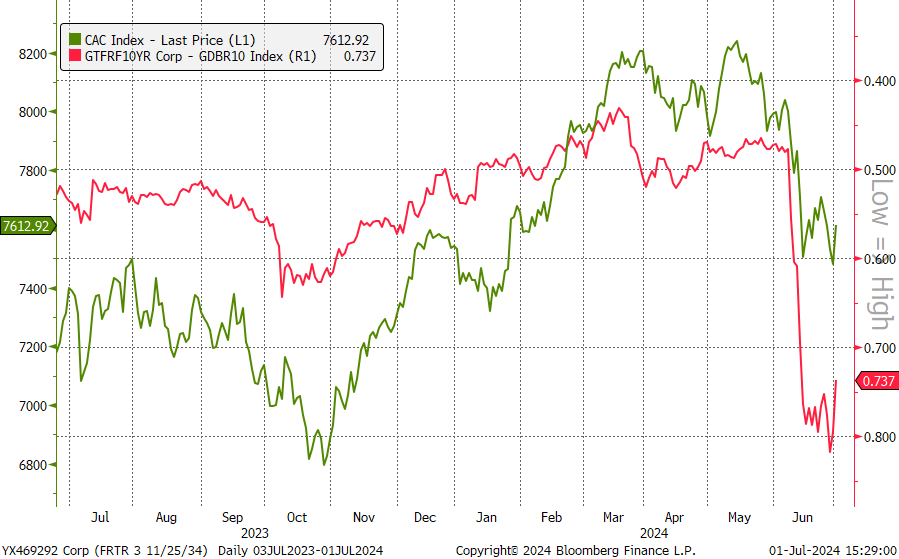

The first round of accelerated elections in France is behind us. As many people expected, it led to a reduction in investor concerns about France's future, resulting in a rebound in the euro, a decrease in the spread between French and German bond yields, and ultimately a recovery in the French stock index CAC 40 (FRA40).

The elections, as expected, were won by the National Rally led by Marine Le Pen, which received just over 33% of the vote with a turnout of almost 67%. The "center" of current President Emmanuel Macron garnered 21% of the vote, slightly better than expected. Although the far-right is likely to take control of the government for the first time in recent years, it will not be a majority government. It is expected that some parties may decide to field a single candidate against National Rally candidates in some districts, which could lead to an even greater decline in support for Marine Le Pen's party.

Previously, the market was greatly concerned about the takeover by the anti-European and populist party. However, it seems that the National Rally will not be able to govern alone, which may mean a lack of radical policy changes. It also appears that the potential takeover by far-left parties is unlikely, as the New Popular Union received exactly 29%, which was in line with expectations.

In response, we observed a noticeable decrease in the yield spread between French and German bonds. However, it's worth noting that overall yields rebounded during today's session. Source: Bloomberg Finance LP, XTB.

The FRA40 is bouncing back today but is largely reducing its gains and nearly closing the entire gap formed at the opening. Earlier, the contract tested recent local peaks at the 7735-point level, which also serves as the neckline of a potential double bottom formation. The range of this formation indicates a target around 8000 points, very close to where the contract was before the accelerated elections were called (8045 points). More importantly, the lower limit of the previous major correction range is maintained at 7415 points. A potential factor supporting the continuation of the FRA40 rebound will be the formation of an inverse head and shoulders pattern on the EURUSD, although the neckline is only around the 1.085-1.090 level. Only a break above these levels could confirm the pattern.

Source: xStation 5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.