Monetary policy announcement from ECB is a key market event of the day. ECB will announce rate decision at 1:15 pm BST, and the announcement will be followed by press conference of ECB President Lagarde half an hour later (1:45 pm BST). ECB is not expected to change level of rates today but may offer hints for the future meetings!

What markets expect?

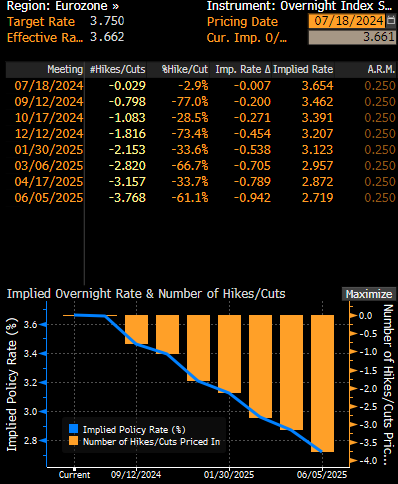

Markets are not expecting European Central Bank to change the level of interest rates at today's meeting. ECB deliver the first rate cut at its previous meeting in June, cutting deposit rate by 25 basis points to 3.75%. However, ECB members have since been quite vocal in their speeches and remarks that there is no need to rush it and back-to-back rate cuts are not the base case scenario. All of 55 economists surveyed by Bloomberg expect ECB to keep rates unchanged today. Money markets price in just a 3% chance of ECB cutting rates today. Pricing for the September 12 meeting suggests an around-80% chance of European Central Bank cutting rates then.

Money markets see a 3% chance of rate cut today and around-80% chance of a cut in September. Source: Bloomberg Finance LP

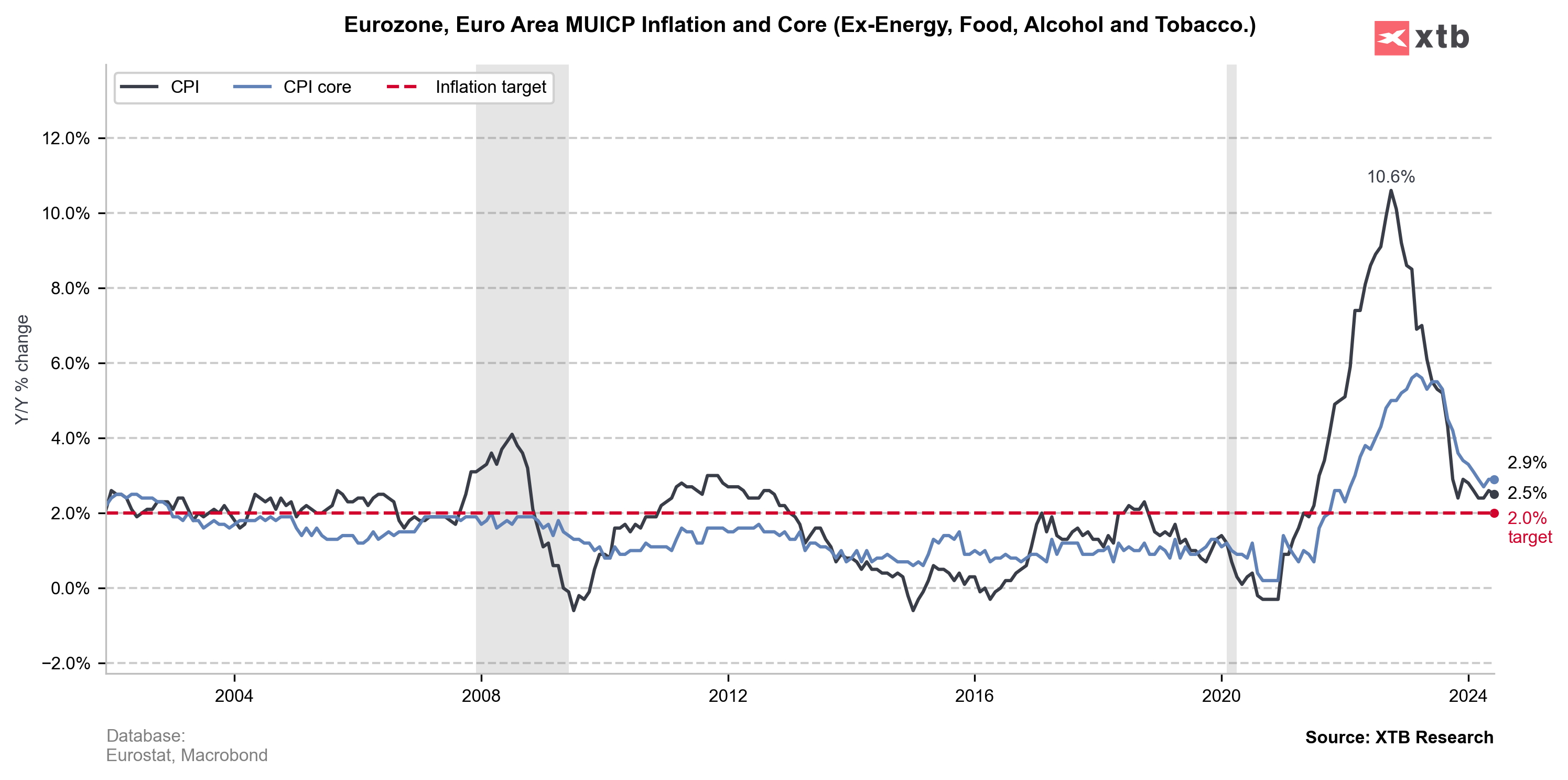

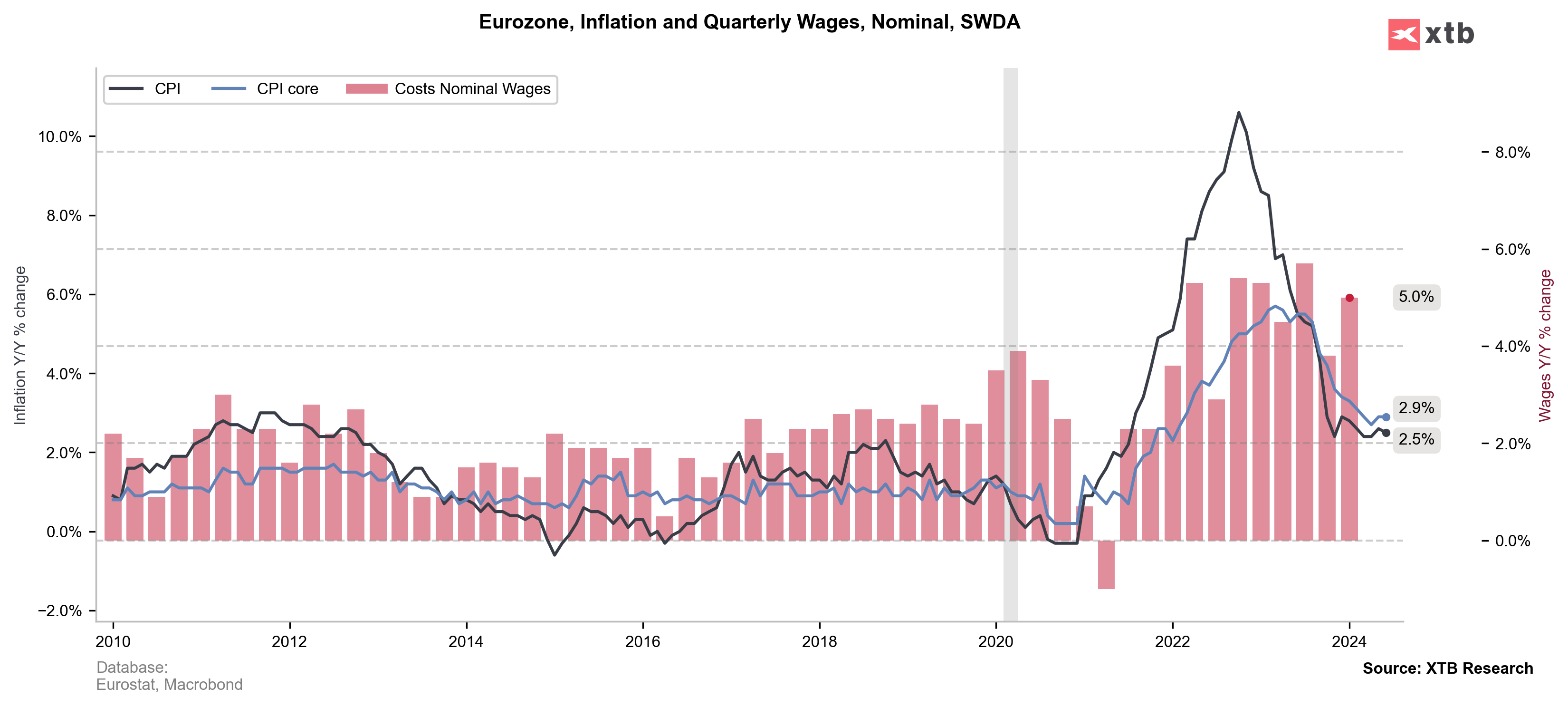

Inflation still above target but goal in sight

There is a rational for ECB to take it slowly with rate cuts. While inflation has slowed considerably from the 2022 peak, it still remains above central bank's 2% target and the slowdown has been halted recently. Also, wage growth remains elevated, what keeps inflationary pressures up. Having said that, it looks prudent for ECB to stay on hold until September when new economic projections will be released. Also, there will be two more CPI prints released before September meeting, what may and ECB may want to wait for those rather than making a decision in a rush.

Rate surprise is highly unlikely therefore investors will focus on a message ECB will try to send. A clear signal that rates will be cut in September is unlikely but some hints may be offered. Indicating that inflation is moving sustainably to the target and will reach it soon, as well as suggestions that further easing is required will be seen as strong dovish hints. Money markets are currently seeing two more rate cuts this year (September and December), but should ECB strike a dovish note today, markets may start price in possibility of October cut as well.

A look at EURUSD and DE40

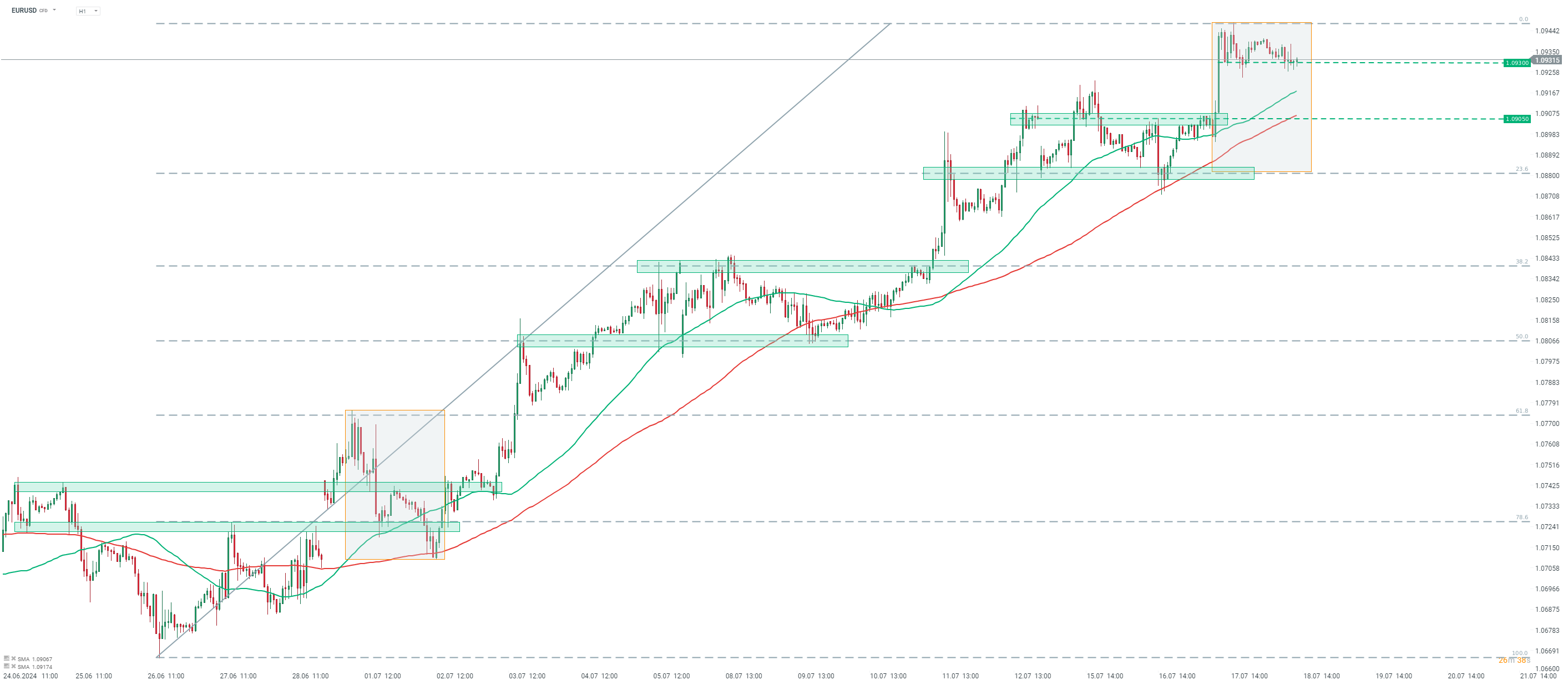

EURUSD has been trading in a strong upward move recently, driven mostly by USD weakening. US currency has been losing ground amid rising odds of Fed launching easing cycle in September. The main currency pair climbed to 1.0948 area recently, the highest level since the second half of March 2024. However, gains were halted there and the pair began to trade in a sideways moves as investors wait for hints from ECB. In case of a dovish surprise in ECB message, the near-term support levels to watch can be found at 1.0905 and 1.0880 (23.6% retracement).

EURUSD at H1 interval. Source: xStation5

EURUSD at H1 interval. Source: xStation5

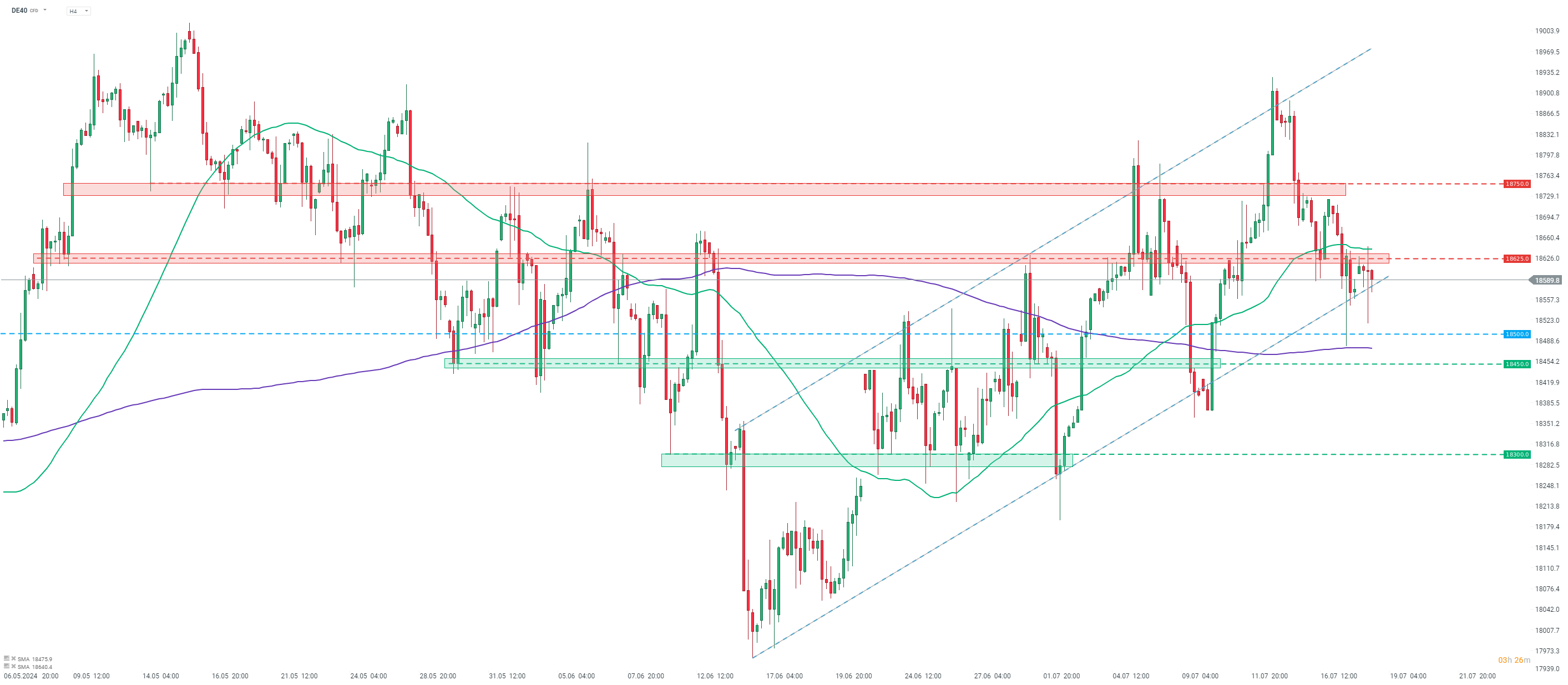

German DAX futures (DE40) took a hit recently, amid a pullback in global equity markets, especially on Wall Street. German index pulled back from a recent local high of around 18,900 pts and dropped 18,500 pts area yesterday, testing 200-period moving average on H4 interval (purple line). Bulls managed to defend the area and push the price back above the lower limit of bullish channel. However, another attempt at breaking below the lower limit of the channel was made this morning. A dovish message from ECB may support sentiment and help end the correction.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.