The Bank of England holds rates at 5.25% in line with market expectations. The decision wasn't unanimous, with 7 central bankers voting for holding rates and 2 voting for a rate cut. The bank noted that members had differing views on inflation, and that the decision not to cut rates appears balanced in the eyes of most. CPI inflation is expected to accelerate in the second half of 2024 to around 2.5% on a yearly basis. BoE chairman Bailey said that the return of inflation to the 2% target can be considered a positive, but more data is needed to determine whether this situation will continue, and thus rates should be kept at restrictive levels.

- BoE expects that inflation will rise in the second half of the year.

- Consensus says that in the long term inflation will decline despite some inflationary pressures in services

- BoE Governor Bailey wants to be sure that inflation will stay at low levels

- The min. wage growth is inflationary, and some bankers point to 'second round effect' inflation from services sector

- Minimum wage can have higher inflationary impact than expected

- BoE survey points to 0.25% quarterly growth and raised forecasts for Q2 2024 GDP growth to 0.5% from 0.2% expected before

- Dhingra and Ramsden from BoE voted for rate cut by 25 bp to 5%

- Interest rates outlook for the rest of the year is unchanged

- Labour market in the United Kingdom is loosing but is still healthy and tight, by past standards

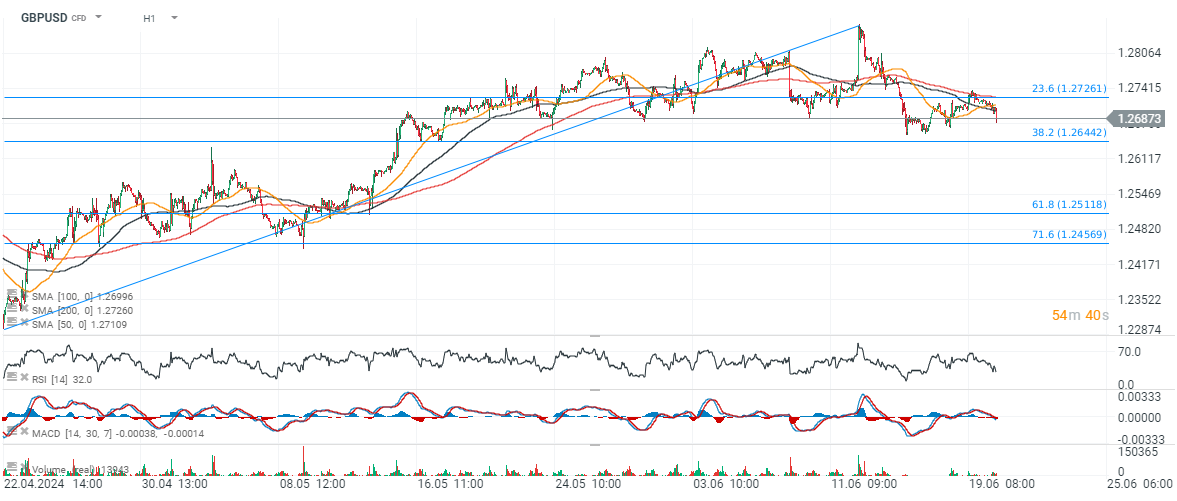

GBPUSD (H1 interval)

The GBP weakened after the decision, with the GBPUSD pair falling about 0.2%. However, this is not a big move from the perspective of recent sessions, so further prospects may depend on the US dollar. The key short-term support is around the level of 1.2645 at the retracement of 38.2 Fibo. The market has once again begun to price a strong chance of a rate cut in August. It is worth noting that the decision will take place after the UK parliamentary elections.

Source: xStation5

Source: xStation5

CPI OVERVIEW: Further Disinflation Puts Fed In Comfortable Position 🏦

BREAKING: US CPI below expectations! 🚨📉

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

The material on this page does not constitute as financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other particular needs.

All the information provided, including opinions, market research, mathematical results and technical analyses published on the website or transmitted to you by other means is provided for information purposes only and should in no event be interpreted as an offer of, or solicitation for, a transaction in any financial instrument, nor should the information provided be construed as advice of legal or fiscal nature.

Any investment decisions you make shall be based exclusively on your level of understanding, investment objectives, financial situation or any other particular needs. Any decision to act on information published on the website or transmitted to you by other means is entirely at your own risk. You are solely responsible for such decisions.

If you are in doubt or are not sure that you understand a particular product, instrument, service, or transaction, you should seek professional or legal advice before trading.

Investing in OTC Derivatives carries a high degree of risk, as they are leveraged based products and often small movements in the market could lead to much larger movements in the value of your investment and this could work against you or for you. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice.