- The dollar is one of the weaker G10 currencies

- Yields on US bonds are falling

- Indices on Wall Street are trying to rebound

US indices open slightly up after mixed PPI data. Volatility has been limited in recent days, and investors are likely waiting for key CPI consumer inflation data tomorrow. At the time of publication, the US100 is up 0.30% and the US500 is up 0.20%.

After today's PPI report, the reaction was increased volatility. The PPI data came in much higher than expected month-over-month, while the annual data remained within the consensus range. Higher monthly readings can be attributed to a downward revision of last month's data for March. Therefore, the monthly price increase was higher, while the annual increase remained close to expectations. After the publication, we first observed declines in stock indices and a significant rise in the dollar. However, shortly afterward, the bulls regained control, and the initial declines were erased. Indices on Wall Street opened in this mood as well.

Start investing today or test a free demo

Open account Try demo Download mobile app Download mobile appAfter hawkish comments from Fed Chairman Jerome Powell, we observed renewed weakness in the indices, which returned to around opening levels.

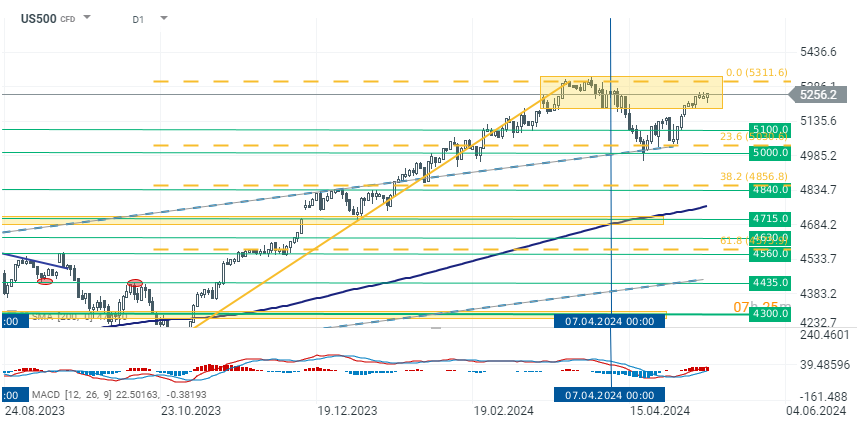

US500

Contracts on the main SP500 index have been in a narrow consolidation channel for three sessions. We will likely see increased volatility and a more decisive move in either direction after tomorrow's CPI data release.

Source: xStation 5

Company news

Shares of GameStop (GME.US) and AMC (AMC.US) surged dramatically on Tuesday, rising by 98% and 121%, respectively. This remarkable increase follows the come back of social media influencer Keith Gill, also known as Roaring Kitty, who was pivotal in initiating the meme stock phenomenon during the pandemic. These gains added to the over 70% increase seen by the close on Monday. The rally also extended to other meme stocks such as BlackBerry and Koss, which saw their shares rise by 13% and 43%, respectively.

Several U.S. clean technology stocks saw significant gains following the Biden administration's announcement of increased tariffs on Chinese electric vehicles and other key industries. SunPower's shares rose by 62%, and Maxeon Solar Technologies saw a 51% increase. Other notable gainers included Sunnova Energy, which was up 23%, and SolarEdge Technologies, which increased by 3%.

Plug Power (PLUG.US) surged by 42% after announcing a conditional commitment for a loan guarantee of up to $1.66 billion from the U.S. Department of Energy. This funding is intended to support the development, construction, and ownership of up to six green hydrogen production facilities across the United States. CEO Andy Marsh stated that this loan guarantee would enable the company to expand its success in green hydrogen production, following the launch of its first commercial-scale plant earlier this year in Woodbine, Georgia.

TeraWulf (WULF.US) shares declined by approximately 7% following the release of its mixed Q1 results. Despite substantial quarter-over-quarter top-line growth of 82% and a significant increase in adjusted EBITDA of 95.4%, the stock faced downward pressure. The company also noted an increase in the total value of Bitcoin self-mined during Q1 2024 ($56.8 million) compared to Q4 2023 ($35.2 million).

Alibaba Group's (BABA.US) shares fell by 7% after reporting mixed FQ4 results. Although the company's top line grew by 7% year-over-year, exceeding consensus estimates, its net profit plunged by 96% year-over-year. This sharp decline was mainly due to a net loss from its investments in public companies during the quarter, compared to a net gain in the same quarter last year. This loss was largely due to mark-to-market changes.

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.